What Is The Fica Cap For 2024

What Is The Fica Cap For 2024. For earnings in 2024, this base. It remains the same as 2023.

The social security wage cap will be increased from the 2023 limit of $160,200 to the new 2024 limit of $168,600. It’s a payroll tax that both employees and employers are responsible.

The Rate Is For Both Employees And Employers, According To The Internal Revenue Code.

It’s a payroll tax that both employees and employers are responsible.

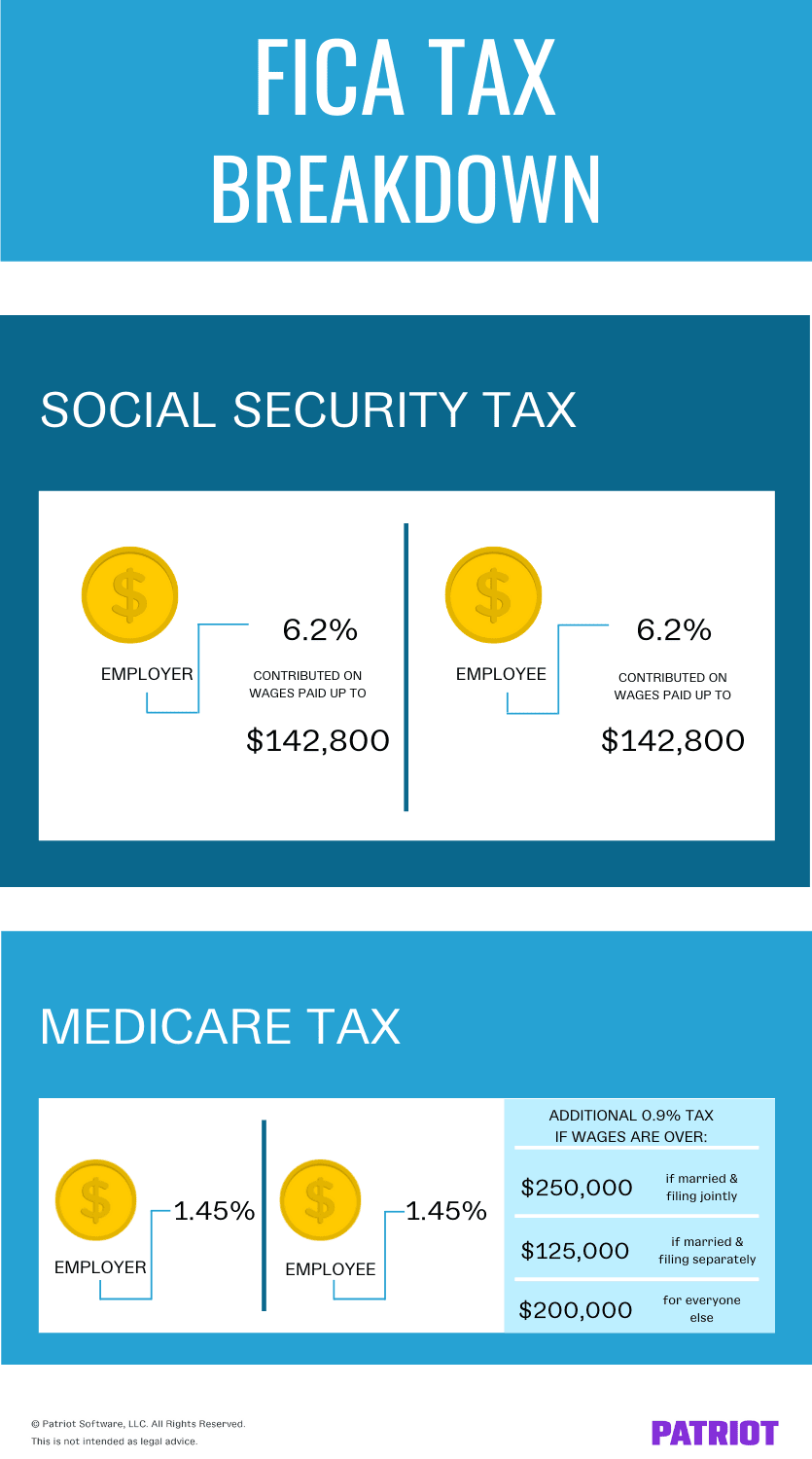

For 2024, The Fica Tax Rate For Both Employers And Employees Is 7.65% (6.2% For Oasdi And 1.45% For Medicare).

Your company sends the money, along with its match (an additional.

What Is The Fica Cap For 2024 Images References :

What Is Fica Limit For 2024 Emyle Isidora, Use our fica tax calculator to estimate how much tax you need to pay for social security and medicare tax in line with the federal insurance contributions act. 6.2% social security tax on the first $168,600 of employee wages (maximum tax is.

Source: mornaqnorrie.pages.dev

Source: mornaqnorrie.pages.dev

Social Security Withholding 2024 Binny Cheslie, For 2024, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare). We call this annual limit the contribution and benefit base.

Source: zaharawkaren.pages.dev

Source: zaharawkaren.pages.dev

Fica And Medicare Tax Rates 2024 Adara, Fica stands for the federal insurance contributions act, and it was introduced in 1935. Federal insurance contributions act (fica) changes.

Source: joseyqmalena.pages.dev

Source: joseyqmalena.pages.dev

Fica Cap 2024 Claire Joann, Federal insurance contributions act (fica) changes. The maximum fica tax rate for 2024 is 6.2%.

Source: youverify.co

Source: youverify.co

Banks Requirements for FICA Verification Youverify, Use our fica tax calculator to estimate how much tax you need to pay for social security and medicare tax in line with the federal insurance contributions act. 6.2% social security tax on the first $168,600 of employee wages (maximum tax is.

Source: www.pinterest.com

Source: www.pinterest.com

Understanding FICA, Social Security, and Medicare Taxes, Learn the complexities of fica tax rates for 2024, from employer responsibilities to withholding calculations and exemptions. It remains the same as 2023.

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-5c8a8f8fc9e77c0001ac17e9.jpeg) Source: www.investopedia.com

Source: www.investopedia.com

Federal Insurance Contributions Act (FICA), The average monthly social security payout for 2024 is $1,907 while the maximum monthly benefit for a worker retiring at full retirement age increased by $284,. Below, you'll find everything you need to know about fica,.

Source: www.familyfinancefavs.com

Source: www.familyfinancefavs.com

Family Finance Favs Don't Leave Teens Wondering "What The FICA?", 6.2% social security tax on the first $168,600 of employee wages (maximum tax is. The maximum taxable income for social security for 2024 is $168,600.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Maximum Taxable Amount For Social Security Tax (FICA), Only the social security tax has a wage base limit. If you make more than that from work, the excess won't be subject to fica, the federal.

Source: blog.sprintax.com

Source: blog.sprintax.com

FICA Tax Exemption for Nonresident Aliens Explained, (for 2023, the tax limit was $160,200. So, if you earned more than.

In 2024, The Social Security Tax Limit Rises To $168,600.

For 2024, the social security tax limit is $168,600 (up from $160,200 in 2023).

With The $168,600 Wage Cap In Place For 2024, The Maximum That Each Party Would Be Responsible For Is $10,453.20, Adding Up To A Total Contribution Of $20,906.40 In.

The social security wage cap will be increased from the 2023 limit of $160,200 to the new 2024 limit of $168,600.